Owing money to the IRS or state authorities can feel overwhelming. If you’re struggling with tax debt, there are multiple solutions available and working with a professional tax resolution company like CuraDebt can improve your chances of success.

Tax authorities, unlike other creditors, have significant power to garnish wages, levy assets, or even seize property, which is why timely intervention is crucial.

Watch This Video: “$10,000 + In IRS Back Tax Debt Issues And Want To Resolve Them?”

Understanding how tax debt affects you is essential. Watch this informative video to see how you can tackle IRS back tax debt issues:

Common Reasons For Tax Debt:

- Failure to File: Not filing a tax return can lead to the IRS filing on your behalf, often leaving out deductions and increasing your tax liability.

- Incorrect Return Preparation: Mistakes on tax returns, either by rushing or hiring unqualified preparers, can lead to penalties and increased debt.

- Missed Estimated Tax Payments: Businesses that fail to make quarterly payments often find themselves in financial trouble when taxes are due.

- Early Retirement Withdrawals: Withdrawing from retirement accounts too early can lead to significant penalties.

- Under-Withholding: Incorrect withholding can result in tax bills during filing season.

Tax Solutions Provided By CuraDebt

If you’re facing tax debt, CuraDebt offers several options to help resolve your issues, including:

- Offer in Compromise (OIC): Settle your tax debt for less than the full amount owed.

- Installment Agreements: Make manageable payments over time to settle your debt.

- Penalty Abatement: Request the removal or reduction of penalties.

- Currently-Non-Collectible (CNC): Pause collections if you’re facing economic hardship.

- Custom Solutions: CuraDebt tailors solutions to your specific situation, providing the best outcomes for resolving your tax debt.

Why Choose CuraDebt?

People choose CuraDebt for providing efficient solutions to IRS and state tax issues, making the process smoother. Their excellent customer reviews highlight their track record of success and reliability in resolving tax debts.

- With over 20 years of nationwide experience, CuraDebt has been assisting clients since 2000.

- The company has earned over 990 five-star reviews on Customer Lobby.

- Transparent, flat-fee pricing ensures there are no hidden costs.

- A skilled team of enrolled agents and tax attorneys handles each case.

- CuraDebt is a proud member of the Online Business Bureau in ‘Good Standing’.

- Clients receive a 100% Free, No-Obligation Tax Debt Consultation.

- Numerous top ratings from other independent review sites reinforce their expertise.

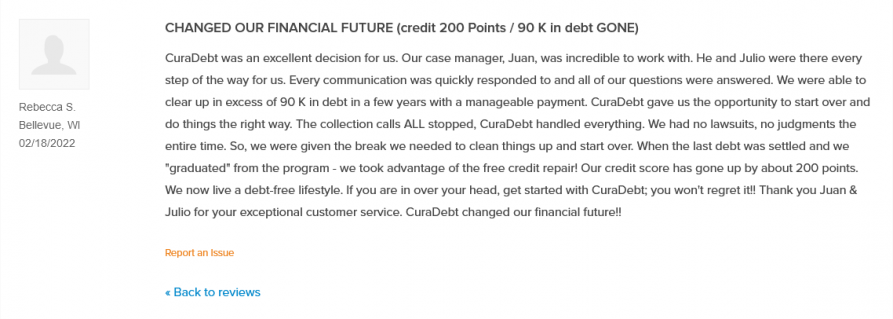

Customer Review – Rebecca S.

“CuraDebt helped us settle $90K in debt, increased our credit score by 200 points, and gave us a fresh start!”

Phased Approach To Solving Tax Issues

- Investigation: Review your financials, tax transcripts, and IRS collection dates to determine the best course of action.

- Compliance: Ensure all missing or inaccurate tax returns are filed or corrected.

- Resolution: Once the investigation and compliance steps are successfully completed, the recommended tax relief solution—whether it’s an Offer in Compromise, Installment Agreement, or another option—is carefully implemented to effectively address and resolve your tax debt.

Watch: 3 Top Consequences Of Tax Debt

Discover the risks of tax debt and learn how to protect your financial future by taking action before it’s too late.

How To Settle With The IRS Quickly

If you’re facing tax debt and wondering how to resolve it, watch the short video “Settle With The IRS” to get a quick overview of the steps involved in settling your tax debt. This video simplifies the process, giving you actionable tips on how to handle negotiations with the IRS and start reducing what you owe. It’s a fast and easy way to understand your options for relief.

Contact CuraDebt For Help

If you’re struggling with tax debt, don’t wait for the IRS to escalate the situation. CuraDebt offers a free consultation to help you explore the best solutions for your unique case.