Offer In Compromise (OIC): Will You Qualify?

What Is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) is a tax relief option offered by the IRS that allows taxpayers to settle their tax debt for less than the full amount owed. It’s designed for individuals who are unable to pay their tax liability in full due to financial hardship. Essentially, this program provides an opportunity for a fresh start by negotiating a reduced amount, but it’s important to understand that not everyone qualifies.

At CuraDebt, we can help determine if you qualify for an OIC and assist you through the application process to maximize your chances of success.

How Do You Qualify for an Offer in Compromise?

To qualify for an Offer in Compromise, the IRS considers several factors, including:

- Ability to Pay: You must demonstrate that you cannot pay the full amount owed.

- Income and Expenses: The IRS reviews your current income and living expenses.

- Asset Equity: If you have valuable assets (like a home or vehicle), the IRS may expect you to liquidate them to pay your debt.

- Compliance: You need to be current on all required tax filings and payments (no ongoing bankruptcy).

Additionally, the IRS uses a formula called Reasonable Collection Potential (RCP) to determine if the offer amount is realistic based on what they believe they can collect from you. Typically, the IRS accepts about 30-40% of OIC applications.

What Are Your Payment Options?

When applying for an OIC, there are two main payment options:

- Lump-Sum Offer: Pay 20% of the offer amount upfront and then pay the remaining balance in five or fewer payments within five months.

- Periodic Payment Offer: Make payments over 24 months while the IRS processes your OIC application

Real-Life Stories: IRS OIC Successes and Struggles

Many taxpayers have shared their personal experiences applying for an OIC on platforms like Reddit, Quora, and X. Here are a few real examples that highlight the challenges and benefits of resolving tax debt with the IRS:

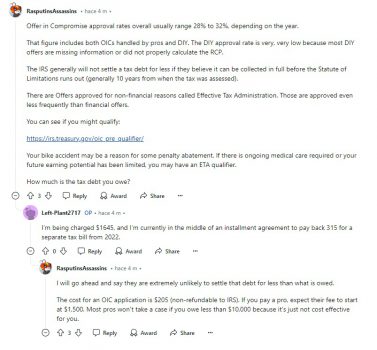

1. Reddit User:

One Reddit user shared, “I tried to settle my debt myself, but the process was overwhelming. Eventually, I hired a tax company, and they helped me negotiate an OIC. It took months, but I ended up paying significantly less than I owed. Definitely worth it!”

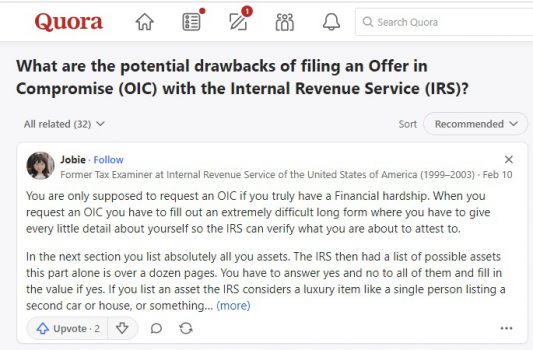

Quora Feedback:

A user on Quora stated, “I was in a tough spot with over $40,000 in back taxes. After applying for an OIC, the IRS rejected my first application. I appealed and worked with a tax professional to revise it. Eventually, the offer was accepted, and I paid around $10,000.“

X User:

One user on X tweeted, “The IRS garnished my wages until I applied for an Offer in Compromise. It took almost a year, but I finally settled for less. Just make sure to stay compliant with taxes after, or they can revoke the deal.”

Why Work with CuraDebt for Your OIC?

Applying for an Offer in Compromise can be daunting, especially when trying to navigate the IRS’s strict criteria. CuraDebt offers personalized guidance, helping you:

- Assess Eligibility: We thoroughly review your financial situation to determine if an OIC is the right option for you.

- Maximize Your Chances: With over 20 years of experience, we can help ensure your OIC application is complete and has the highest chance of approval.

- Stress-Free Process: CuraDebt handles all communication with the IRS, allowing you to focus on your financial recovery.

Get a free consultation today to explore your options for tax debt relief.

What Happens if Your Offer Is Rejected?

If your OIC is rejected, the IRS allows you to appeal within 30 days. It’s essential to submit any missing documentation or clarify your financial situation. Working with a professional can improve your chances of success during the appeal process.

Conclusion: Will You Qualify for an Offer in Compromise?

An Offer in Compromise can provide significant tax relief, but it’s crucial to meet the eligibility requirements. By working with a trusted tax professional like CuraDebt, you can navigate the process more effectively and potentially reduce your tax burden. Contact us today for a free consultation and take the first step toward resolving your tax debt.